Graphene Capital Asset Management

Optimize wealth with strategic asset management solutions.

7%yield

As of FY: 2022 - 2024

Graphene Capital Asset

Management

Our Manager helped to grow assets at a rate of 7% in the last financial year. Achieve steady growth with our personalized Asset Management services.

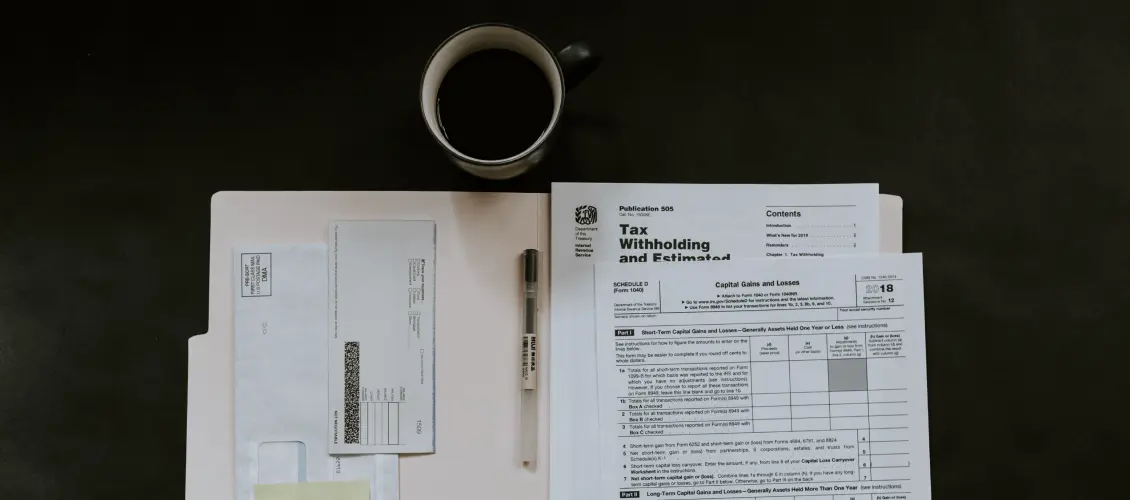

What is Asset Management?

A money market fund is a type of fixed income mutual fund that invests only in highly liquid, short-term debt. These funds offer a low level of risk because they invest in low-risk investments like government-backed securities. You can use a money market fund to save for short-term goals such as a wedding, a down payment on a home, or an unexpected life event.

What are the Services of Asset Management ?

Portfolio Analysis and Optimization

Thoroughly analyze and optimize investment portfolios to align with financial goals, risk tolerance and market conditions, ensuring efficient wealth growth.

Risk Management Solutions

Implement strategies to identify, assess and mitigate investment risks, safeguarding assets against market volatility and optimizing risk-adjusted returns

Financial Planning and Consultation

Provide personalized financial planning and consultation services, offering expert guidance on investment strategies, retirement planning and overall wealth management.

Diversification for Risk Mitigation

Asset management enables diversifying investments across various classes, reducing the impact of poor performance in a specific asset and helping to manage overall portfolio risk.

Strategic Portfolio Optimization

Asset managers strategically allocate and rebalance portfolios to optimize returns based on market conditions, financial goals and risk tolerance, ensuring efficient wealth growth over time.

Diversification for Risk Mitigation

Asset management enables diversifying investments across various classes, reducing the impact of poor performance in a specific asset and helping to manage overall portfolio risk.

Strategic Portfolio Optimization

Asset managers strategically allocate and rebalance portfolios to optimize returns based on market conditions, financial goals and risk tolerance, ensuring efficient wealth growth over time.

Venture beyond conventional money market funds in asset management.

Want to learn more?

Strategies for Optimal Resource Utilization and Business Success

In the ever-evolving landscape of business, effective asset management is the linchpin for sustained success. Whether you're a small startup or a large enterprise.

A Comprehensive Guide to Investment, Risk and Reward

The stock market, with its dynamic nature, offers both opportunities and challenges for investors. Navigating this financial landscape requires a strategic approach.

A Comprehensive Guide to Building and Growing Your Investments

In the dynamic world of finance, portfolio management stands as a cornerstone for investors seeking to optimize returns and manage risk effectively.

Latest News

- All Posts

- Finanace

- Investments

- News

- Stock Market

Frequently asked questions

Risk management is crucial in asset management to assess, monitor and mitigate potential risks. Asset managers work to align investment strategies with clients’ risk tolerance and financial objectives.